Is Inflation Hurting Yet?

What on earth is happening? Thousands – at least – of Americans are asking this question as they leave the grocery store each week with less after paying more. Not too long ago there was plenty of cash flow and prices were within reason. Now? Not so much. Which is how inflation usually creeps onto the scene.

There is a picture circulating of an actual gas price sign:

Regular Unleaded: Arm

Plus Unleaded: Leg

Super Unleaded: Both

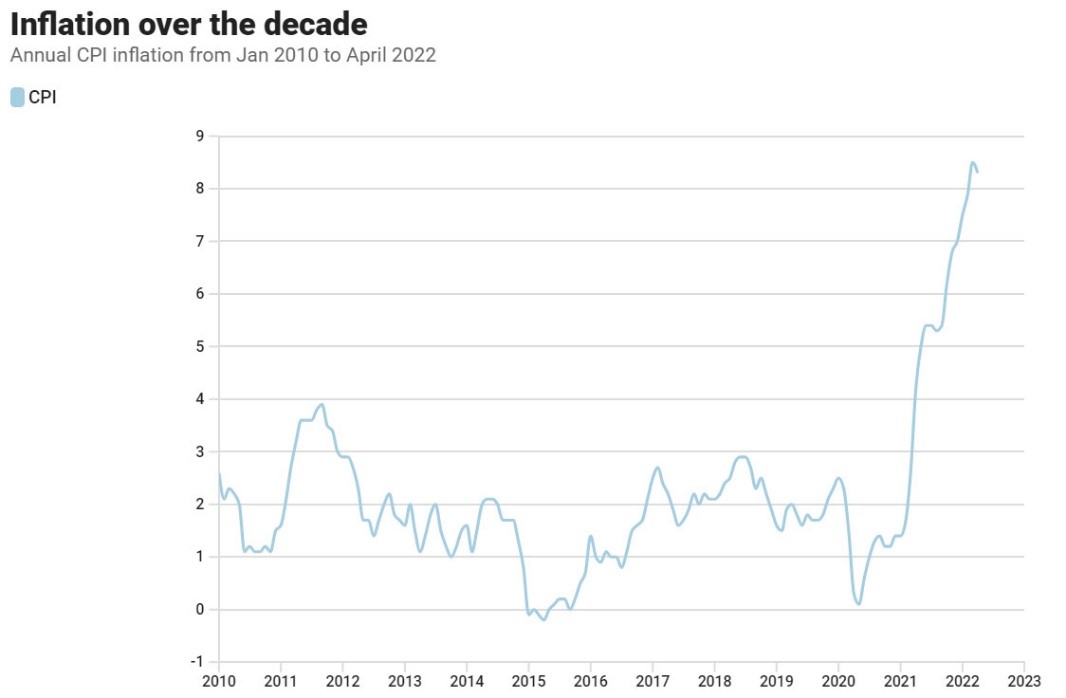

We can chuckle… until we look at the reality in our shrinking bank balance. An 8.3% inflation rate is hovering at nearly a 40-year high. Most Americans cannot relate to this or were too young to know any different. It seems history really does repeat itself. Until now, inflation was just some vague risk your financial advisor talked about that you weren’t really worried about. Now…? Well, take a look at this chart from the Bureau of Labor Statistics:

Yup! That explains it. So now the question is what do you do about it?

Yes. There are the advanced financial pieces that need attention now. Your investments, insurance, borrowing, business, cash, and other interest exposure may not feel the pain until it is too late. You need to be analyzing your entire financial picture if you have not already. Obviously, things are moving fast in the world of inflation.

Then there is your pocket book. This is the stuff you are probably starting to feel.

Maybe…we will just stay home instead, wait to do this, hold off for a bit, buy the generic brand, start cooking, grow a garden, raise chickens…

Jiminy Cricket is getting louder and louder my friends. So, take this as your cue to have a hard look at your current circumstances. Twice today, I have seen this message of caution:

“Discipline is choosing between what you want now and what you want most.” Abraham Lincoln wrote that.

That “stuff” we buy probably won’t be important in the long run. In fact, I know it won’t. Its time to look at your priorities. Where are you spending your dollars on? I recommend three places:

- Oxygen

- Experiences

- Other People

We all want and need to breathe, live healthy, and be happy. “Stuff” isn’t what supplies that. Necessities do. Lifestyle choices. What is your “oxygen?” What isn’t?

The newness wears off of “stuff” pretty quick. Then it becomes junk. There isn’t much you can do with junk unless American Pickers come your way. Experiences, on the other hand, have quite a bit of shelf life. I cherish the memories I have playing games with my family, the ski trips, and the laughs of living in the country. The best part is I will have these as long as my mind is sound…and my kids do too.

Wanting more “stuff” is a first world addiction. On the other hand, it is a blessing to be a blessing. When it comes to our family and our kids, sometimes the best gift is to say ‘No’, but that is topic for another day. Truly helping someone may be a gift for that someone, but it is a bigger gift to you.

Inflation bites, but not as bad as our bad habits. Don’t let it be the scape-goat. You may not be able to control the price of things, but you can control the priority.