The Next Big Investment Scam

Could you fall victim to it? The stock market is hot right now and greed is coming out to play. Recently we had a client ask for a double-digit return on her investments. This is the same lady who wanted to go to cash when the market fell apart in 2008. There is common saying – “you deserve the return you get” – that certainly applies here, as well as to a multitude of other investors today.

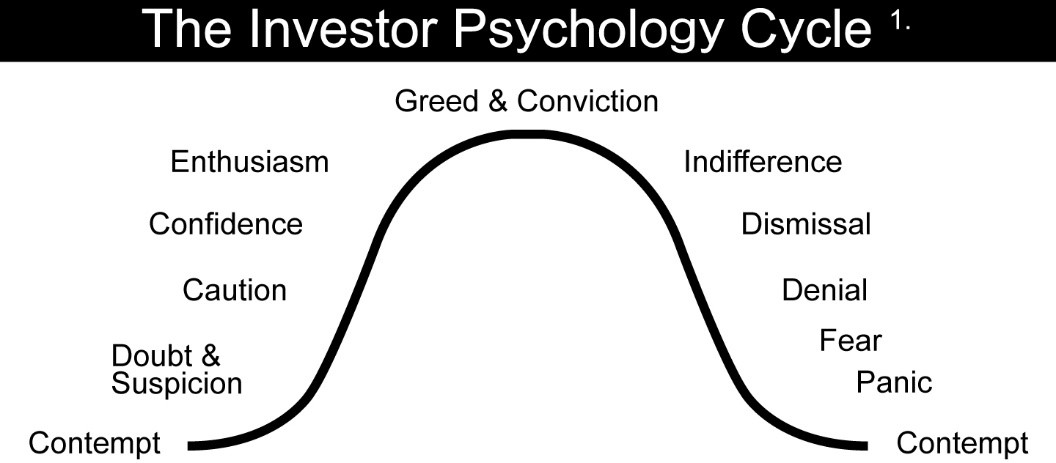

Investor psychology illustrates this perfectly.

Investors are wanting more and more even if their risk tolerance cannot truly support their desires. Which is ultimately a recipe for disaster. Worse than just buying high and selling low, their search to quench their thirst may put their money in the hands of something called “too good to be true.” Let’s take a little trip down memory lane.

Do you recall the company Mutual Benefits from the 90s? This “too good to be true” viatical settlement company defrauded approximately 30,000 victims. It appeared to offer the perfect investment. Or what about Enron defrauding 74 billion dollars from investors? It was the stock that just kept going up. Or what about the “biggest fraud scheme ever” – Bernard Madoff Investment Securities. The name alone should have been a dead giveaway. A lone man cheated 4,800 investors out of 65 billion dollars on the sole idea that their money would keep growing at double-digit returns despite the market.

And although these are some of the biggest and baddest schemes in American history, the Fraud Research Center estimates that Americans lose 40 to 50 billion dollars to fraud every single year.2 Which brings us back to the original question: Could you fall victim to the next big investment scam? Today I want to give you an insight into how to recognize and avoid the next big scheme.

Frankly, the next big scheme will occur when greed or fear prevails over level heads. Remember the tech bubble? Greed set in when a 15% return was considered lousy. Edmund Burke wisely stated that “Those who don’t know history are destined to repeat it.” Here are 4 rules of discipline to place and keep in the forefront of your investment handbook to help prevent you from falling prey to the fallacies that greed breeds:

- If it looks and sounds too good to be true…well I won’t say it is, but a BIG warning flag should pop up! Do your due diligence and continue with #2. And don’t forget – fraud isn’t always committed through means which are completely unknown to you. Criminals know that the best way to solicit you is to make you comfortable. This means beware of and question anything—annuities, fees, penny stocks, banks. These are all common tools to victimize investors.

- Make sure the advisor is legitimate. Anyone can call themselves a financial planner or advisor today—scary, but true. A legitimate securities salesperson must be properly licensed, and his/her firm must be registered with FINRA, the Securities and Exchange Commission, or a state securities regulator, depending upon the type of business the firm conducts. And an insurance agent must be licensed by the state insurance commissioner where he or she does business. So, start your research with these:

-

- For a Broker, use FINRA BrokerCheck at finra.org or call toll-free (800) 289-9999.

- For an Investment Adviser Firm, use the Securities and Exchange Commission at sec.gov. (Note: this is the firm whom the advisor is associated with and will be noted in the disclosure on all materials used.)

- For an Insurance Agent, check with your state insurance department. You’ll find contact information through theNational Association of Insurance Commissioners NAIC at naic.org.

- For All Sellers, be sure to call your state securities regulator. You can find that number in the government section of your local phone book or by contacting the North American Securities Administrators Associationat nasaa.org or (202) 737-0900.

Additionally, check with national organizations that issue credentials such as:

Certified Financial Planner Board of Standards—Certified Financial Planner at www.cfp.net or the International Foundation for Retirement Education—Certified Retirement Counselor at www.infre.org.

Last, but not least, ask to see the advisor’s ADV Form, Part II, which is filed with the SEC. This form contains information about the advisor’s background, services and fees.

- Know the difference between the individual who manages your money (investment manager) and a custodian. This should not be one entity—if it is, you should immediately begin to research the situation. The investment manager only executes transactions. A custodian is in possession of your account and issues your statements. If a manager wants the check made out to him/herself, this may be a large red flag.

- Stay rational. Investments are cyclical. If you live long enough you will see investments will rise and fall. And yes, you along with many others will be shocked when it happens. The key is to stay rational. Don’t act on every irrational thought that occurs to you. If you can’t do it alone find someone unemotionally attached to your money and in an unbiased position to help you make wise decisions in good times and in bad.

- Keep educating yourself. While researching for this article, I came across an outstanding publication by Debbie Stephenson named “10 Famous Investment Scams.” Not only were the stories astonishing, but she ended everyone with a punchline—how investors should learn from this in the way of performing their due diligence. You can read it here: https://www.firmex.com/thedealroom/10-famous-investment-scams/.

The bottom-line answer to our question is a little dissonant. Your emotions coupled with your decisions will decide your fate 99 percent of the time. And in the end that means it all boils down to three things.

- “Know thyself” – well!

- Have a long-term game plan to avoid the fallacies caused by temporary greed and fear.

- Keep a trusted advisor to help you keep yourself in check.

And, by the way, don’t wait until it is too late to start! Begin right here and right now. You can learn what your investment risk tolerance in less than 5 minutes by clicking here: https://www.kennedy-financial.com/p/investment-stress-test.