Preventative Financial Care

The August 2008 Money Magazine offered up an article of several successful individuals talking about the smartest financial advice they have ever received. Billionaire and CEO of Virgin records, Richard Branson shared a story about his lack of knowledge in the financial realm and being humble about what you don’t know. Have you ever noticed that everyone you know (billionaire or not) knows everything about money—how to make it, use it, spend it and invest it. If you asked 10 of your friends, business associates and family member the same random question about money, I bet none of them will give you the same answer… unless, of course, they all listen to the same financial guru talk show host. Why is this – beside the fact that each of us has a little rugged- individualist in us and believes we know the best way?

I agree with Mr. Branson: you just don’t know what you don’t know. And often times it is what you don’t know that will hurt you. If you just focus on the answers to specific questions, you may not find out what you don’t know and miss the boat entirely. It’s about knowing the right questions that need to be asked relevant to your unique situation. You would probably agree with me that your situation is much different from those of your friends, business associates and family members. You have different lifestyles, goals and dreams about the future, families, financials and feelings regarding risk vs. reward. A cookie-cutter answer rarely applies—especially with today’s ever-changing economic uncertainty.

Think of your 3 favorite restaurants. Now imagine the head chef from each made their very best dish for you. Sounds splendid, right? Of course, but just imagine if you took a big bowl and mixed these three dishes together with a wire whisk. How does that sound? Not very tasty, right? So, why do we do that with our money? We take a piece of advice from one person or specialist here and a piece of advice from another person or specialists there without referring to what the other has done and mix them together. That’s not to say these pieces of advice standing alone are not superb, but they may not mesh well together amid your overall, unique situation.

Life Planning is centered on the questions you don’t know to ask that need to be answered. Here’s another analogy: you’re sick and have no clue what’s wrong. Do you know the questions the doctor is going to ask you to help find your illness and ultimately your cure? Maybe a few of them, but not all of them. Do you know if the doctor will need to recommend one or two specialists to consult over your situation? Possibly, but probably not. Moreover, do you know what medical recommendation the doctor will prescribe you? My guess is no.

Many individuals make the assumption that money is about money. Well, it is and it isn’t. It is really just the nutrition in your overall preventative healthcare plan. You have to have it, but you need a little exercise, sleep, relaxation and an annual physical as well to make your plan successful. We wrote an article in the past titled “Preventative Care” To sum it up…Life Planning is preventative care plan for your family’s financial health. If you haven’t read it, I recommend visiting the learning center at www.kennedy-financial.com and checking it out.

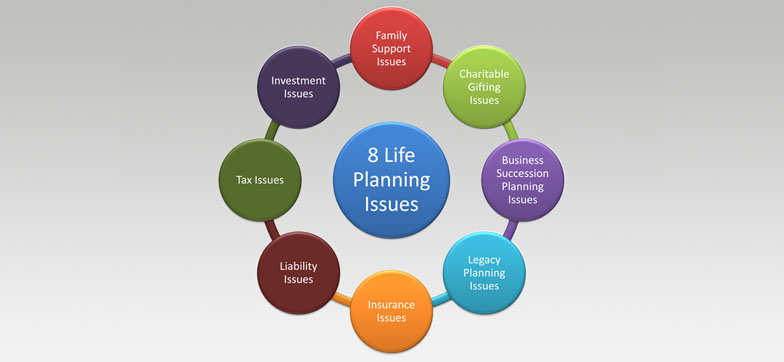

So, what exactly is this preventative health care plan? For us, it is addressing the 8 Life Planning Issues:

- Family Support Issues

- Charitable Gifting Issues

- Business Succession Planning Issues

- Legacy Planning Issues

- Insurance Issues

- Liability Issues

- Tax Issues

- Investment Issues

When and if these issues become a priority is not the same for every family, so we have found that it is incumbent on our firm as the general physician of the overall life planning team to take a disciplined approach to managing these issues.

Over 35 years of working in various fields of Life Planning has shown me that most people don’t plan to fail –they just fail to plan. And one reason behind this procrastination is that they are overwhelmed by the complexity of the task and don’t know where to start. I feel it is very important for every family to seek help and take the time to focus on the questions that need to be addressed. I encourage you to be proactive as opposed to reactive and live your life on Purpose!