Last week, we talked about the Top 3 Costly Mistakes in Transitioning Your Business. Notice who didn’t make that list? Uncle Sam. Why? Because if your business can’t even attract a buyer at a strong price, taxes don’t matter yet. (If you missed that article, I’d recommend starting there first.) But let’s assume your business…

Read more

Let’s be blunt: Business owners are slightly emotional about their businesses, especially as time approaches for them to step away from control of their business. A lot of blood, sweat, and tears went into building your business – sleepless nights, times you didn’t know if you would make it, and sacrifices you still wonder if…

Read more

I love starting my day with a little time in the Word, and recently I was listening to a sermon that hit me right between the eyes. The pastor asked a simple but powerful question: Where are you getting your advice? It made me pause. Every day, we let different voices shape our thoughts and…

Read more

Do you really know? Your first response may be, “everything” or “a lot of things.” But is that really the heart of the matter? Take Stan. Stan is a successful business owner living in a small town, raising two wonderful kids with his wife. Owning a business is “a lot.” Most business owners wear multiple…

Read more

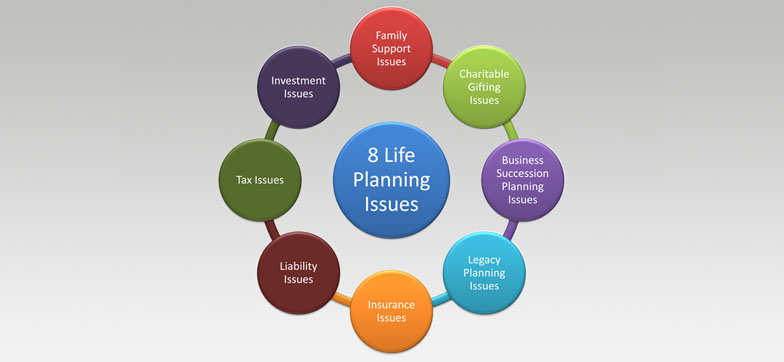

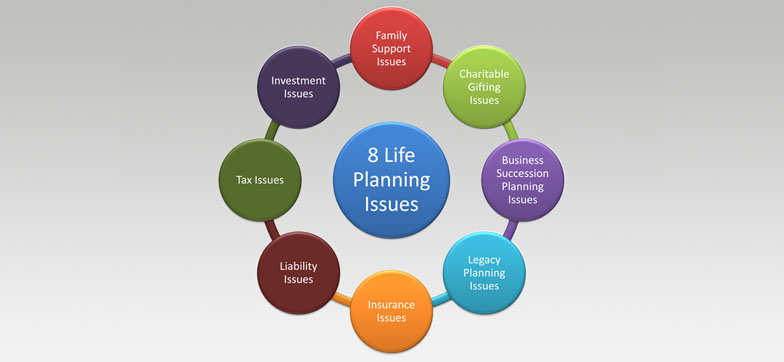

Most people don’t even know how to answer that question, much less feel confident enough to answer with a resounding “yes.” The truth is that most assets are naturally not ‘asset protected.’ This means that unless you have done some planning and maneuvering specifically aimed at asset protection, well… These are the most common issues…

Read more

What is a fiduciary? A person or organization that acts on behalf of another person, putting their clients’ interests ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other’s best interests. –Investopedia.com With retirement plans, there…

Read more

The August 2008 Money Magazine offered up an article of several successful individuals talking about the smartest financial advice they have ever received. Billionaire and CEO of Virgin records, Richard Branson shared a story about his lack of knowledge in the financial realm and being humble about what you don’t know. Have you ever noticed…

Read more

It doesn’t matter whether you own a Mom-and-Pop shop, a family farm or ranch, a Fortune 500 company or anything in between…When you have a family business, you often need a reality check to keep your business what it it—a business. I obviously work with family members every day. I often catch myself using a…

Read more

Do you have life insurance for your business and/or owned by your business? If so, the death benefit is supposed to be tax free, right? It might be. It might not be. Or worse, it could be taxed twice. Let me tell you a story about Joe. He owned a very successful business with his…

Read more

Wow! 2021 has been a whirlwind… sometimes literally in paper. It seems we have had a new proposal almost every day from lawmakers. Social Security alone has been addressed in 10 different bills this year. And taxes? Keeping up with introduced or impending changes is a full-time job. The good news is that we are…

Read more

Securities offered through Calton & Associates, Inc. member FINRA and SIPC, a Registered Investment Adviser. SEC registration does not imply a certain level of skill or ability.

Investment advisory services offered through Smart Money Group, LLC, a Registered Investment Adviser.

Smart Money Group, LLC and Kennedy Financial Services, Inc. are not owned or controlled by Calton & Associates, Inc.