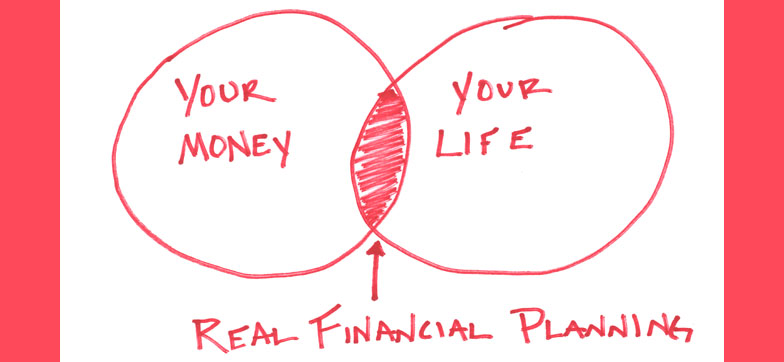

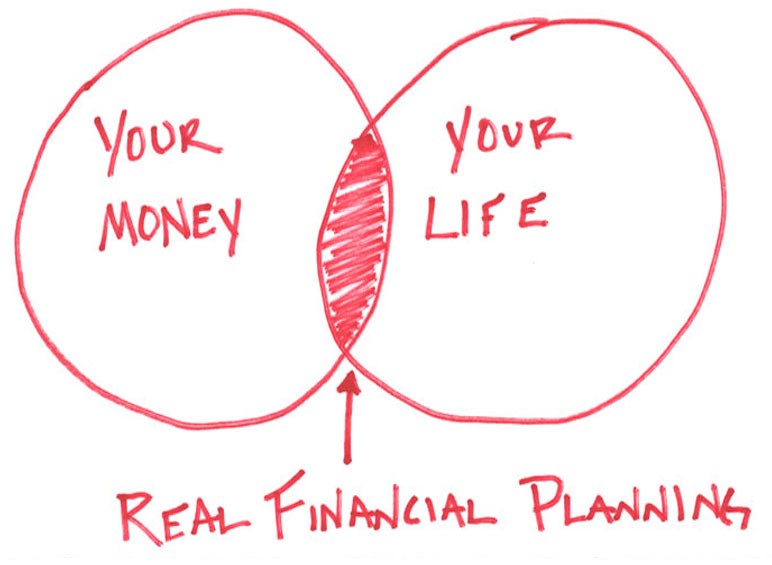

Real Financial Planning

In this world of vast information, just about anyone can claim to be a financial advisor. Moreover, the McDonald’s of financial advisors are popping up on every corner in those big brand names you recognize. Unfortunately, this means most of the advice families receive is generic information. I say “Unfortunately” because very few families have generic lives where generic information applies. Just think about your neighbor. Even if you neighbor lives in the same size home and drives the same type of car, does that mean your goals are the same? What about your families, how you spend your money, your retirement dreams, and your feelings about risk and reward?

I don’t think financial planning is about bits and pieces of good information, selling a product or investment, or even going through that book full of figures and projections most call a financial plan. Think about just the basic idea of saving for retirement. Which would be the most effective?

- Save a certain dollar amount for ‘x’ amount of years and hope you have saved enough when retirement is closing in.

- Obtain a financial plan based on a percentage of your living expenses, then begin saving ‘x’ amount of dollars described in this plan.

- Determine and discuss what you want to accomplish during life before and during retirement, as well as the legacy you want to leave behind for your community and/or family. Set goals and create a plan to accomplish these dreams. Review and revise your goals and plan on a regular basis.

My opinion, of course, is number 3. Did you notice; however, the word “dollars” or “money” was not used even once in number 3? This by the way is why we call ourselves a Life Planning Firm, which is what real financial planning is.

Planning is not always about the answers or even the right answers. It is about knowing the right questions to ask and addressing those. The most remarkable thing about this post era of the credit-crisis is ironically that money is no longer about money and making money. We are finding that families we are meeting for the first time today versus five years ago are looking for someone to guide them through a life-money connection that involves profound questions about their current situation, future and goals, beliefs and values and family.

Recall the definition of a goal. It is simply a dream with a deadline. Now, I don’t know about you, but I don’t have many dreams of being surrounded with loads of money. I dream about Living Life on Purpose. Money just happens to be a major tool in this life as we know it.

So, I guess this leaves me with just one question: Do you have a Real Financial Plan?